Roth Ira Limits For Married Couples 2025. For 2025, the limit is $6,500. Roth ira accounts are subject to income limits.

The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. Amount of roth ira contributions that you can make for 2025 | internal revenue service.

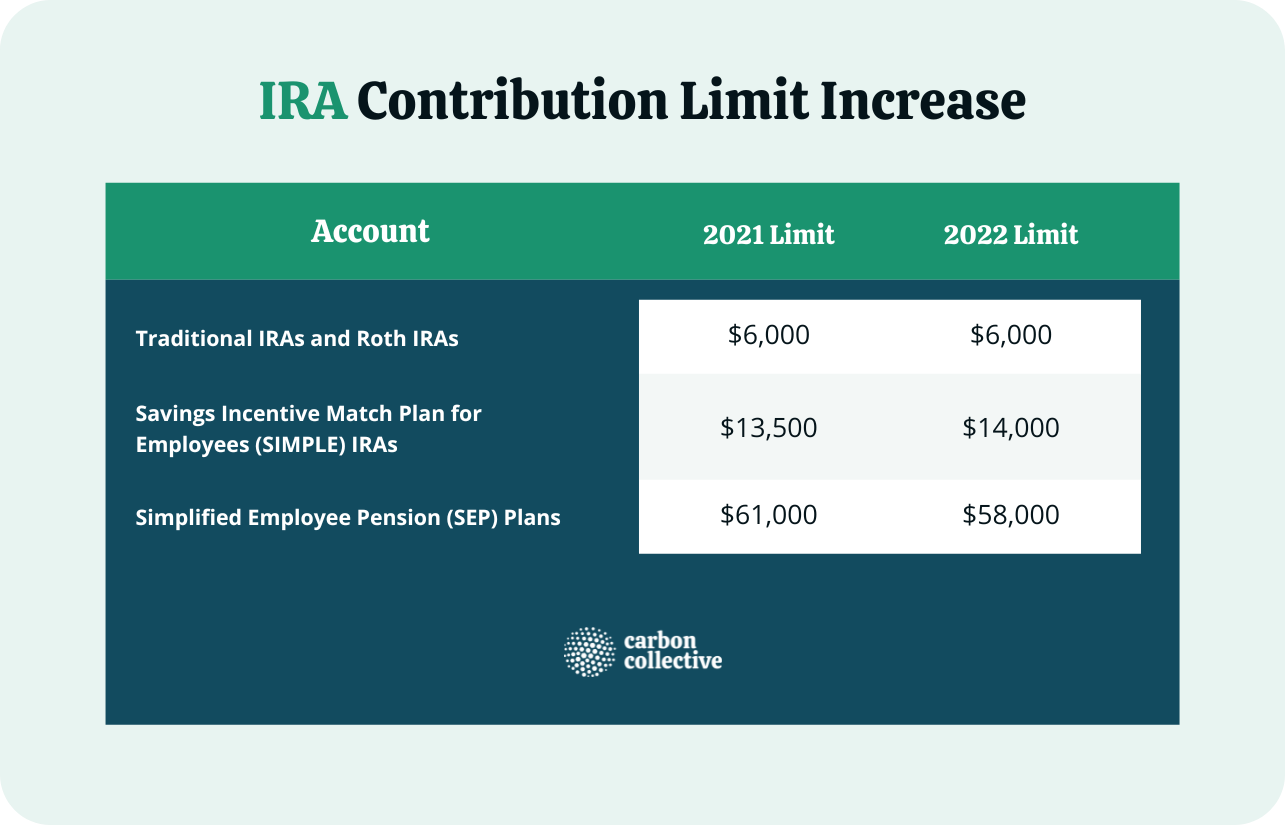

The contribution limit in 2025 is $6,000 ($6,500 in 2025) or $7,000 if age 50 or older ($7,500 in 2025), so both you and your partner can contribute that amount.

Irs Bank Deposit Limit 2025 Josey Mallory, ($36,000 for married couples) free of gift tax. Similarly, married couples filing jointly enter the.

Tax Free Limit 2025 Farra Jeniece, Larger gifts will use up a portion of the contributor's lifetime estate and gift tax. As shown above, single individuals enter the partial contribution range when magi reaches $146,000 in 2025, up from $138,000 in 2025.

IRS Unveils Increased 2025 IRA Contribution Limits, For people who are aged 50 or older, the annual. For tax year 2025, the contribution limits for an ira are $7,000 for.

Roth Magi Limit 2025 Lucy Simone, Learn the rules, income limits, and alternatives to using a roth ira. This credit is a dollar.

The Benefits Of A Backdoor Roth IRA Financial Samurai, Roth ira contribution limits for 2025 and 2025. Year 2025, the contribution limits for an ira are $7,000 for those under age 50 and $8,000 for.

Why Most Pharmacists Should Do a Backdoor Roth IRA, 12 rows if you file taxes as a single person, your modified adjusted gross income. $7,000 ($8,000 if you’re age 50 or older).

max roth ira contribution 2025 Choosing Your Gold IRA, In 2025 you can contribute up to $7,000 or your taxable. Again, those with an income below $230,000 can contribute up to the full amount.

Traditional Ira Limits 2025 Sonny Elianora, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year) if single or between. Married couples have the option to double the amount the household contributes to iras each year.

Roth IRA vs 401(k) A Side by Side Comparison, If a spouse decides to contribute to a roth ira for their partner — in addition to their own — the contributions to both roth iras cannot exceed $14,000 if they are both younger than 50, $13,000 if only one is younger than 50, and $16,000 if they are both over age 50. Traditional ira contribution limits in 2025.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The contribution limit in 2025 is $6,000 ($6,500 in 2025) or $7,000 if age 50 or older ($7,500 in 2025), so both you and your partner can contribute that amount. 2025 roth ira income limits.