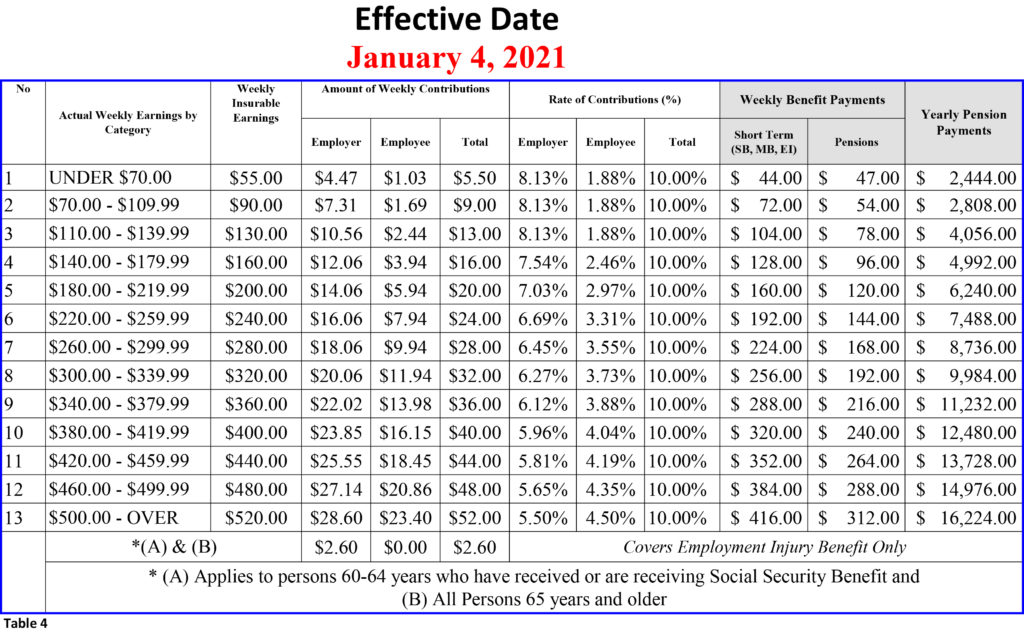

Social Security 2025 Withholding. You aren’t required to pay the social security tax on any income beyond the social security wage base limit. From there, you'll have $1 in.

The federal government sets a limit on how much of your income is subject to the social security tax. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of.

How To Calculate, Find Social Security Tax Withholding Social, What should employers know about social security tax? You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, As mentioned, one way to avoid tax surprises is to have federal income taxes withheld from your social security. The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2025.png)

Limit For Maximum Social Security Tax 2025 Financial Samurai, You can ask us to withhold federal taxes from your social security benefit payment when you first apply. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Social Security Withholding Calculator 2025 Tax Withholding Estimator, In 2025, only the first $160,200 of your earnings are subject to the social security tax. In 2025, the limit was $160,200.

Federal Withholding Tables 2025 Federal Tax, You aren’t required to pay the social security tax on any income beyond the social security wage base limit. We call this annual limit the contribution and benefit base.

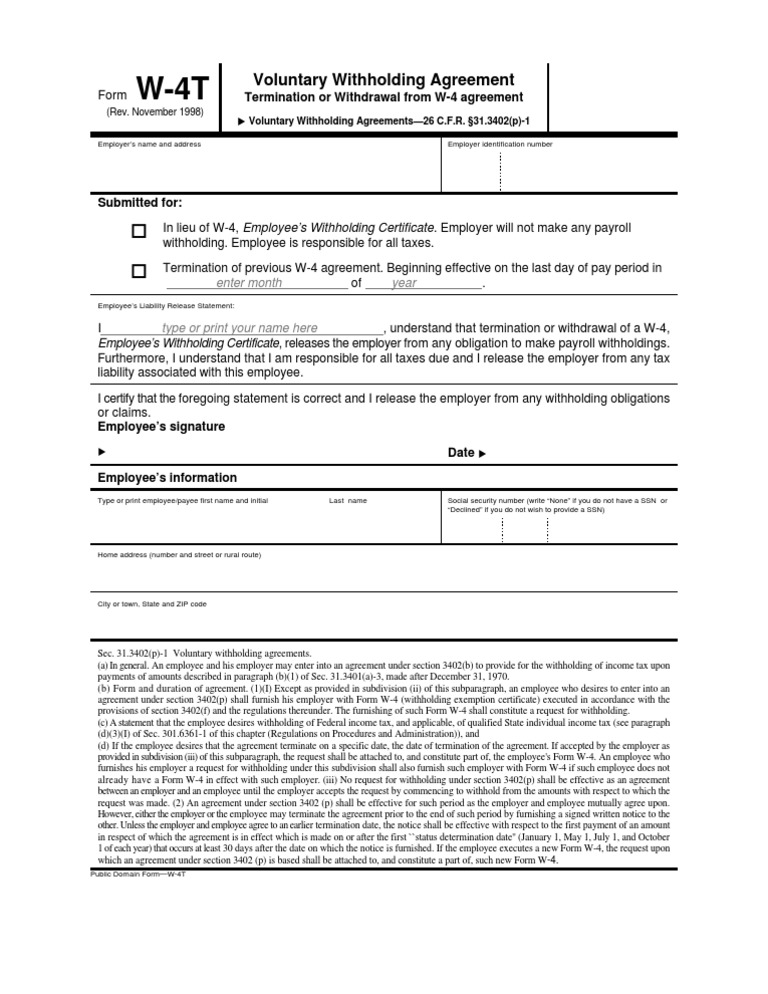

w4t Withholding Tax Social Security Number, From there, you'll have $1 in. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Maximum Taxable Amount For Social Security Tax (FICA), As mentioned, one way to avoid tax surprises is to have federal income taxes withheld from your social security. In 2025, the first $168,600 is subject to the tax.

Social Security 2025 Calendar 2025 Calendar Printable, In that case, you can earn up to $59,520 without having benefits impacted. We call this annual limit the contribution and benefit base.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, As mentioned, one way to avoid tax surprises is to have federal income taxes withheld from your social security. In 2025, the limit was $160,200.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The social security tax limit is set each year. Are social security benefits taxable?

If you are working, there is a limit on the amount of your earnings that is taxed by social security.